FINCA Bank has signed a partnership agreement with the OJSC «The guarantee fund» on providing guarantees for the loans by the OJSC «The guarantee fund» to the clients.

The OJSC «The guarantee fund» provides assistance to businessmen representing small and medium enterprises by means of providing additional collateral. The Fund increases the accessibility of loans by becoming security under the guarantee provided by the bank, if the client lacks means for providing collateral.

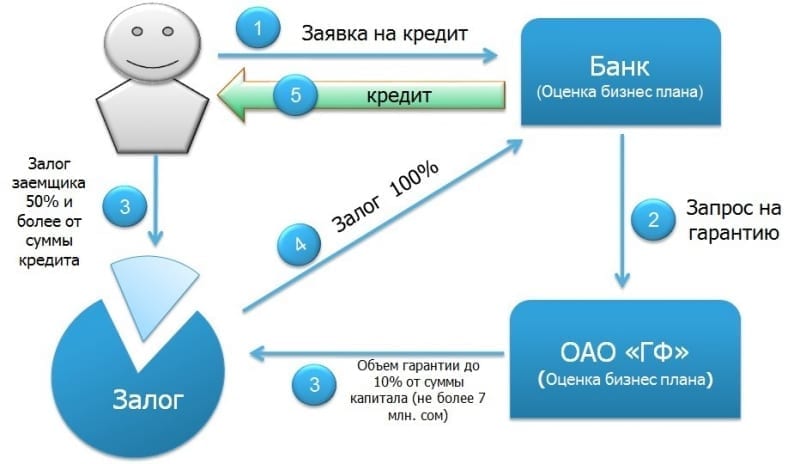

Following the mechanism of cooperation, after the approval of the loan by the bank in principle, the bank directs those clients, whose solvency is acceptable, but the collateral is insufficient for receiving a loan of the requested size, to the OJSC «The guarantee fund»

The OJSC «The guarantee fund» provides guarantees in respect of loans to the amount more than 300, 000 soms and for a period of at least 12 months, and the amount of the guarantee can reach 50% of the collateral. The cost of providing a guarantee for clients is 2% – 2,5% of the amount of the guarantee. SME lending is one of the key directions of activities of the CJSC “FINCA Bank. FINCA Bank promotes development of of entrepreneurship in Kyrgyzstan via various loan facilities.

The program of the OJSC «The guarantee fund» makes provision for providing guarantees in the course of taking loans by clients who have troubles with providing collateral.

How does the mechanism of receiving guarantees work?

The client shall turn to the Bank with an application for a loan, after the Bank considers the application in accordance with the normal procedures and evaluates the possibility of the loan disbursement and its size based on the information of the received information and the provided collateral.

If the Client’s cash flows are sufficient for serving the requested amount, but the cost of the collateral he/she provides is insufficient to receive the necessary amount of money, the Bank suggests the client to turn to the OJSC «The guarantee fund».

If the client agrees to turn to the OJSC «The guarantee fund», the Bank provides the client’s data to the Fund which makes a decision about the approval/ refusal within 10 days.

The OJSC «The guarantee fund» notifies the Bank about the decision it takes. In the case of the positive decision the Bank shall formalize providing a loan to the client.

In the course of providing guarantees by the Fund the priority directions are production and processing of agricultural products, textile and clothing industry, production of construction materials, trade, support of the green economy, support of entrepreneurship of women.

The terms and conditions, as well as the mechanism of providing guarantees of the OJSC «The guarantee fund»